Starting a limited company is an exciting venture, but it comes with its share of responsibilities. One critical task you’ll face is opening a bank account tailored for your business. Unlike personal accounts, a business bank account offers features designed to manage your company’s finances efficiently, ensuring you stay compliant with HMRC regulations.

Choosing the right bank account can significantly impact your company’s financial health. With numerous options available, understanding what to look for and what benefits each account offers can be extremely useful. In this article, you’ll discover the essential factors to consider when selecting a bank account for your limited company, helping you make an informed decision that supports your business’s growth and success.

Choosing the Right Bank Account for Your Limited Company

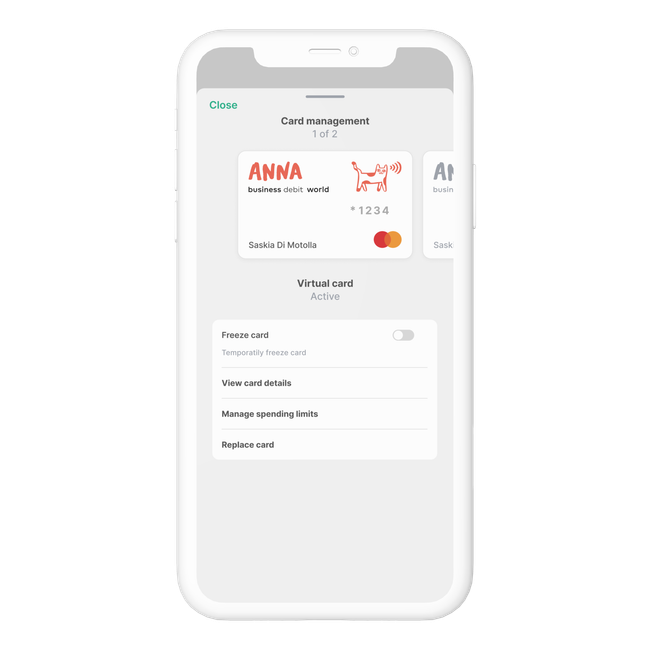

When it comes to selecting a bank account for limited company operations, important features need to be evaluated. What services does the bank offer? Ensure it supports easy payment processing and invoicing. Look for accounts that provide online banking with mobile accessibility. Enhanced digital tools can save time and increase efficiency.

Transaction fees can impact your business finances significantly. Search for accounts with low charges or fee-free transactions, especially for high-volume activities. Always check for hidden costs that might affect your budgeting.

Interest rates also warrant attention. Some business accounts offer interest on deposits. While this might seem minor, over time it can enhance your company’s cash flow. It’s wise to compare different banks to find the most favourable rates.

Think about customer service quality as well. Companies often encounter unexpected issues. Reliable support is crucial for quick resolutions. This might include 24/7 customer service or a dedicated account manager who understands your business needs.

Security features are paramount. Protecting your business funds and information is non-negotiable. Opt for banks with robust encryption and fraud detection capabilities. Two-factor authentication and detailed transaction notifications add layers of security.

Does the bank provide integration with accounting software? This feature simplifies record-keeping and helps maintain accurate financial records. Seamless integration can reduce accounting errors and enhance overall efficiency.

Common Mistakes in Selection

Many businesses stumble when choosing a bank account due to overlooking key factors. Avoid the pitfall of selecting a bank purely based on location. While convenience is needed, the chosen institution must meet all your business banking needs.

Don’t neglect to read the fine print. Terms and conditions can hide unfavourable clauses. It’s easy to miss out on this and face unpleasant surprises later. Scrutinising these details can save a lot of hassle.

Another frequent mistake is focusing solely on introductory offers. Bonus incentives might look appealing but ensure the account remains beneficial after the promotion period ends. Long-term suitability often trumps short-term gains.

Failing to assess the bank’s digital capabilities can lead to inefficiencies. Ensure the bank’s technology aligns with your company’s operational requirements. Quality digital services can streamline processes thereby boosting productivity.

Lastly, avoiding comprehensive reviews of customer feedback is unwise. Previous clients’ experiences can reveal a lot about the bank’s reliability and quality of service. Look for consistent positive feedback rather than isolated comments.

As you weigh your options, always anchor your decision in your company’s specific needs. Only by doing so can you secure a bank account that fosters your business’s growth and stability.

Comparison of Top Bank Accounts for Limited Companies

When choosing a bank account for your limited company, you might consider major banks like HSBC, Barclays, and Lloyds. These institutions offer established services and extensive branch networks. HSBC, for instance, provides robust online banking and integration with accounting software, which is essential for seamless financial tracking.

However, challenger banks such as Starling, Revolut, and Tide also merit consideration. They often use innovative technologies for more efficient services. Starling could be especially attractive due to its fee-free transactions and user-friendly app. Revolut, with its multi-currency accounts, aids international business dealings. Tide simplifies expense management through automated categorisation.

Which appeals more to you? The traditional reliability of major banks or the cutting-edge innovation of challenger banks? Both have strengths depending on your company’s unique requirements.

How to Open a Bank Account for Your Limited Company

Necessary Documentation

Opening a bank account for your limited company involves several steps. First, gather the required documentation. Banks need to verify your company’s identity and legality. They might ask for your company’s certificate of incorporation. This document proves that your company is registered in the eyes of the law.

You may also need to provide your company’s Memorandum and Articles of Association. These outlines your company’s structure and purpose. Founding members and their roles within the company should be included in these documents.

Directors’ details are crucial too. They’ll want to see proof of identity for each director. A passport or driving licence usually works best. Don’t forget proof of address documents like bank statements or utility bills.

Finally, the bank might request your company’s business plan. This document shows your business strategy and financial forecasts. It helps banks understand your company’s future and assess any risks.

The Application Process

Next is the application process. This involves several stages. You start by selecting a bank. Consider factors like services, fees and customer support. Research various banks to find one that suits your business needs best.

Once you’ve picked a bank, you need to complete the application form. Each bank has its own form, either online or on paper. Make sure you fill out all fields accurately to avoid delays. After submitting your application, banks usually run a credit check. This assesses the financial stability of your company. Providing accurate information can streamline this process.

Personal meetings might be part of the process. These meetings allow the bank to understand your business better. You can also ask any questions you have about the bank’s services during these sessions.

Once approved, you’ll receive your account details. This typically includes your account number and sort code. These details enable you to start managing your company’s finances officially. Opening a bank account for your limited company equips you to manage finances efficiently. Being prepared with the right documents and understanding the process helps ensure smooth navigation.

Managing Your Limited Company Bank Account

Focus on keeping all transactions separate from personal accounts. This clarity will assist during tax filings. Monitor all expenses closely to avoid overspending. Did you know regular reviews can unveil unnecessary costs? Consider setting up alerts for low balances or large transactions. This proactive step keeps you informed of your company’s financial health.

Cash flow represents your company’s lifeblood. Always ensure sufficient funds for operations and emergencies. Budgeting effectively qualifies actions and forecast income versus expenses. Try allocating a portion of income to an emergency fund monthly. Will you need external funding? It’s wise to explore options before they become crucial.

Are your invoices being paid on time? Late payments can disrupt your cash flow. Set clear payment terms and follow up promptly on overdue invoices. Automated reminders might ease this task.

Integrating Account with Accounting Software

Connecting your bank account to accounting software simplifies financial tracking. Real-time updates provide immediate insights into your financial status. Many solutions offer integration options, saving time and reducing manual errors.

Curious how it works? Transactions import automatically into the software. Categorisation might happen by default, but ensure accuracy via regular checks. This integration supports seamless reconciliation, matching bank statements with your financial records. Is your software capable of generating insightful reports? These can guide decisions by revealing trends and anomalies.

Payroll management benefits from this integration. Payments track efficiently, reducing potential discrepancies. Added tools can handle invoices, giving a full financial picture from a single interface. If growth is an ambition, scalable solutions adapt as your business evolves.

This combined approach promotes efficiency, accuracy and informed decision-making. Wouldn’t those advantages support your company’s financial health?

Last Thoughts

Choosing and managing a bank account for your limited company is crucial for maintaining financial stability and fostering growth. By separating business and personal transactions, closely monitoring expenses, and integrating with accounting software, you’ll streamline your financial operations. This approach not only ensures accuracy but also supports informed decision-making. Remember setting up alerts and handling late payments promptly will keep your cash flow healthy. With these strategies in place, your limited company will be well-equipped to thrive financially.